What is a 1098-T?

>The 1098-T is an informational form that outlines qualifying payments made to the college on a students' account for a specific calendar year.

It is important to note that 1098T forms issued by DMACC are for informational purposes only; students receiving a 1098T form should consult a tax professional regarding education related tax benefits or implications when filing their taxes. The 1098T form is also used to report qualifying 3rd party payments or scholarships. Defined by the IRS, a qualifying payment includes balances paid towards the cost of tuition, fees, and course material required for enrollment. For more details regarding the 1098-T please contact a tax professional or refer to the

IRS Website.

Depending on your income (or your family’s income if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970, page 9.)

If you would like a total account summary that shows all charges billed and payments made on your account, please send an email from your DMACC email account to

mybill@dmacc.edu

Where can I find my 1098-T?

A copy of the form 1098-T is available to students online in Banner Self Service.

Accessing your 1098-T Tuition Statement

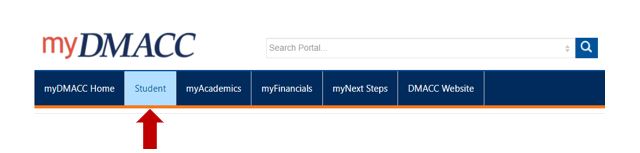

- Log in to

myDMACC and select the Student tab.

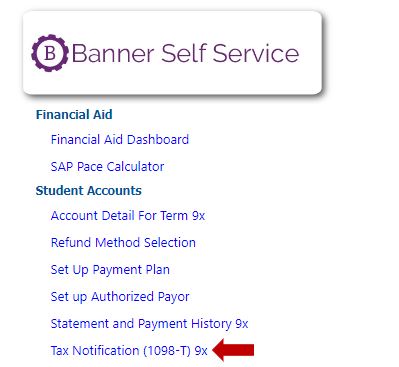

- Under the Banner Self Service icon, select

Tax Notification (1098-T) 9x.

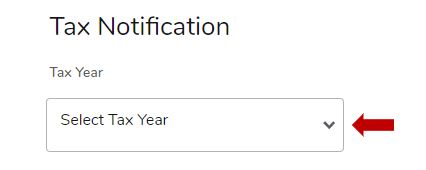

- Select the Tax Year for the 1098-T you would like to view.

When will my 1098-T be available?

If a student has agreed to receive their 2022 1098-T form electronically, it will be available in the Banner Self Service beginning January 19, 2023. For students not receiving a 1098-T electronically, physical copies will be mailed via USPS by January 31, 2023.

What information is included in the 1098-T?

1098T forms issued by DMACC are for informational purposes only. Please consult a tax professional regarding education related tax implications.

Box 1 - Qualified Payments

The amount reported in box 1 is the total amount of payments received less any reimbursements or refunds made during the calendar year. The amount reported is not reduced by scholarships and grants reported in box 5.

Box 4 - Adjustments made for a Prior Year

Reporting of reimbursements of payment or reductions in qualifying expenses from previous tax years.

Box 5 - Scholarships or Grants

The amount reported in box 5 generally include all payments received from a third party; including scholarships, grants, governmental, and private entities. Box 5 does not include payments made from family members or loan disbursements.

Box 6 - Adjustments to 3rd party payments

All adjustments to scholarships, grants, and 3rd party payments from previous years will be reported in box 6.